Suited for someone building or rebuilding their credit, the Platinum card discourages you from overspending with its lack of a rewards program, intro APR and sign-up bonus. Capital One Platinum: Best for building credit Just remember, when you miss a payment with these cards, you’ll still be charged with a late payment fee of up to $40. That way, you can focus your efforts on catching up on missed payments rather than penalty fees. If you run into a stretch of bad luck and repeatedly miss payments, you won’t be surprised with a higher interest rate than you were expecting. With the Quicksilver and the Platinum, however, you don’t have to worry. With other cards, if you miss a payment, your balance would be charged a penalty rate and a late fee. No penalty feeĬapital One credit cards do not charge a penalty APR rate.

#Quicksilver one credit limit full

As for the Platinum, it’s another nice perk to get you focused on making regular and full payments.

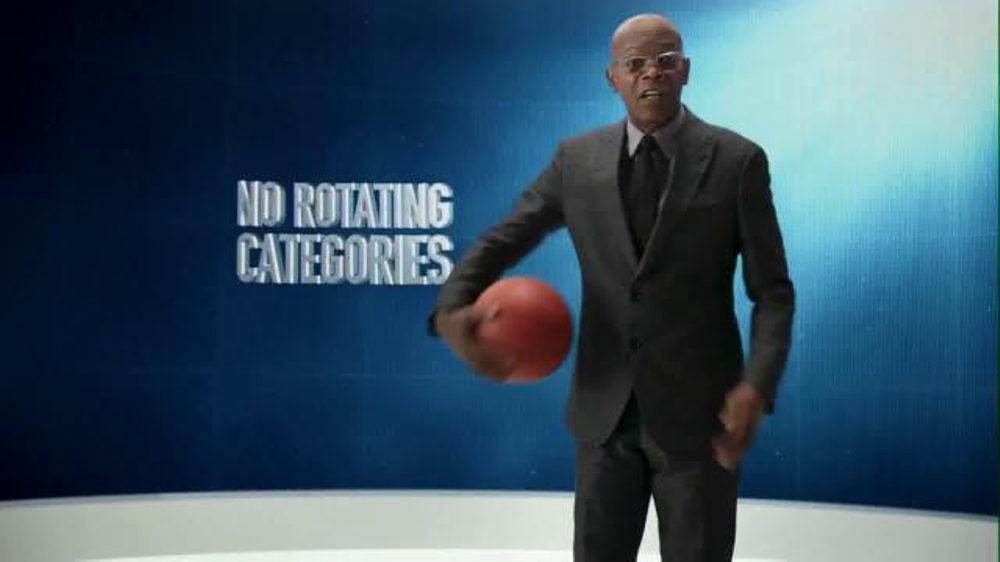

You don’t have to feel obligated to specifically spend with the Quicksilver to make up for a hefty annual fee. The no annual fee is a nice advantage for the Quicksilver. No annual feeīoth the Capital One Quicksilver and the Capital One Platinum don’t charge an annual fee. Because the Quicksilver card gives you 1.5% cash back, no matter what you’re purchasing, there’s no need to keep track of any bonus categories with your spending. This low-maintenance cash back card is ideal for cardholders who want to earn a significant amount back but don’t want to put too much effort into their earnings. If you like the idea of earning rewards alongside your spending, the Quicksilver Rewards card is the clear winner. The Capital One Platinum has no rewards whatsoever. $200 cash back when you spend $500 in the first 3 monthsĮstimated yearly rewards value (for someone who spends $15,900) Do you want a cash back card that rewards you for spending, or do you want to improve your credit with responsible use? Card Capital One Platinum card featuresĭeciding which card is best for you depends on how high your credit score is and what you’re looking for in a credit card. If you pay your bill on time six months in a row, for example, your account is automatically reviewed for a credit limit increase. Instead, its biggest selling point is its forgiving stance toward cardholders rebuilding their credit. It doesn’t offer a rewards program, nor does it offer a sign-up bonus. The Capital One Platinum card is a plain vanilla credit card designed for cardholders who want to build or rebuild credit with responsible use. It offers a flat 1.5% cash back rate that can add up to big savings for cardholders who use it regularly. The Capital One Quicksilver card is a high-yield cash back card designed for cardholders with good to excellent credit. But aside from their affiliation with Capital One, these two cards are a world away in terms of the benefits they offer and the reasons why a cardholder might choose them. Sto transfer ships between characters.The Capital One Quicksilver Cash Rewards Credit Card and the Capital One Platinum Credit Card share the same issuer.

0 kommentar(er)

0 kommentar(er)